do pastors pay taxes on their income

Whatever their status they must pay income tax to the IRS for all of their earnings. Applying for Tax-Exempt Status Employer Identification Number EIN Every tax-exempt organization including a church should have an employer iden-tification number whether or not the organization has any employees.

Either way the government is getting your money.

. A pastor typically pays their own payroll taxes as if they were self-employed. Members of the Clergy. A pastors housing allowance is subject to SSFICA tax but not income tax.

Yes pastors pay federal income tax. Nonprofit organizations and churches do not have to pay income taxes on unearned income. And like the rest of us if you dont have an employer withholding those taxes on a regular basis then you have to pay quarterly estimated taxes four times a year.

Apply to the IRS for tax-exempt status unless their gross receipts do not normally exceed 5000 annually. Updated November 20 2020 An ordained minister is a common law employee of a church for income tax purposes and is taxed on offerings wages and fees for ministerial. Section 107 of the Internal Revenue Code clearly allows only.

This rule applies if any part of your net earnings from each of the two years came from the performance of ministerial services. If excess housing allowance is taken it must be allocated as income. The two years dont have to be consecutive.

Because you have to pay the taxes yourself if you dont. Not every staff member at the church can take this allowance. Because the church has unrelated business income it must file a federal income tax return.

How do churches file taxes. They must pay social. Since they have dual status as self-employed and as an employee of the church a.

A pastor may be unclear about. The housing allowance is for pastorsministers only. You must file it by the due date of your income tax return including extensions for the second tax year in which you have net earnings from self-employment of at least 400.

Clergy must pay income taxes just like everyone else. What taxes does a pastor pay. Yes and no While it is true that churches merely by the virtue of truly being churches enjoy tax-exempt status from federal corporate taxes that.

Some pastors opt out of the social security and. When a pastor is self-employed they may be able to deduct some of their home allowance. Like the rest of us you pastors have to pay federal income tax.

One may not opt out of paying federal income tax on wages and excessive reimbursements of costs. In fact the real answer to this question is. Unfortunately the rules for clergy income taxes can be especially confusing.

Churches who earn an unrelated business gross taxable income of 1000. Do pastors and priests pay taxes. For services in the exercise of the ministry members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld.

It will file Form 990-T Exempt Organizations Business.

Q A How Churches Pastors Are Eligible For Relief In Stimulus Package Baptist State Convention Of North Carolina

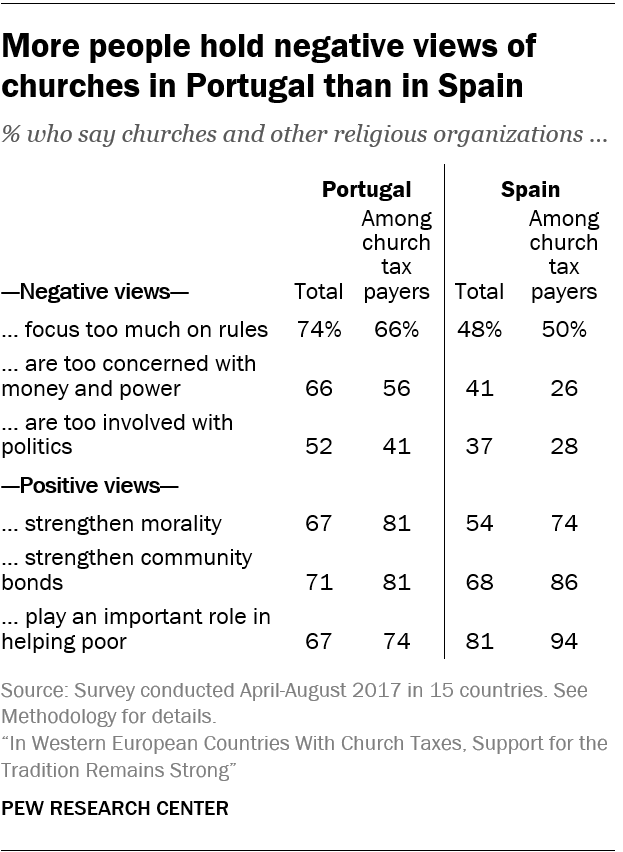

A Look At Church Taxes In Western Europe Pew Research Center

Why Don T Churches Pay Payroll Taxes For Ministers The Pastor S Wallet

Startchurch Blog The Must Know Facts About Housing Allowance

The Ultimate Church Compensation And Salary Guide Reachright

Pastor Or Minister Compensation Tips

The Pastor S Guide To Taxes And The Irs Ascension Cpa

Who Is Responsible For The Clergy Housing Allowance The Pastor Or The Church The Pastor S Wallet

How Will A Biden Presidency Affect Taxes For Pastors The Pastor S Wallet

Huge Infographic On The Business Of Mega Churches Tax Exempt Average Pastor Income 147 000 Many In The Millions Sees Gifts Of Bentleys And Rolls Royces Attendance Growing 8 Per Year Just Take A Look

Do Churches Pay Payroll Taxes Aps Payroll

Dual Tax Status What Does It Mean For Your Pastor American Church Group Texas

The Pastor S Guide To Taxes And The Irs Ascension Cpa

Clergy Tax Guide Howstuffworks

How To Determine If A Pastor Is An Employee Or Self Employed For Federal Tax Purposes The Pastor S Wallet

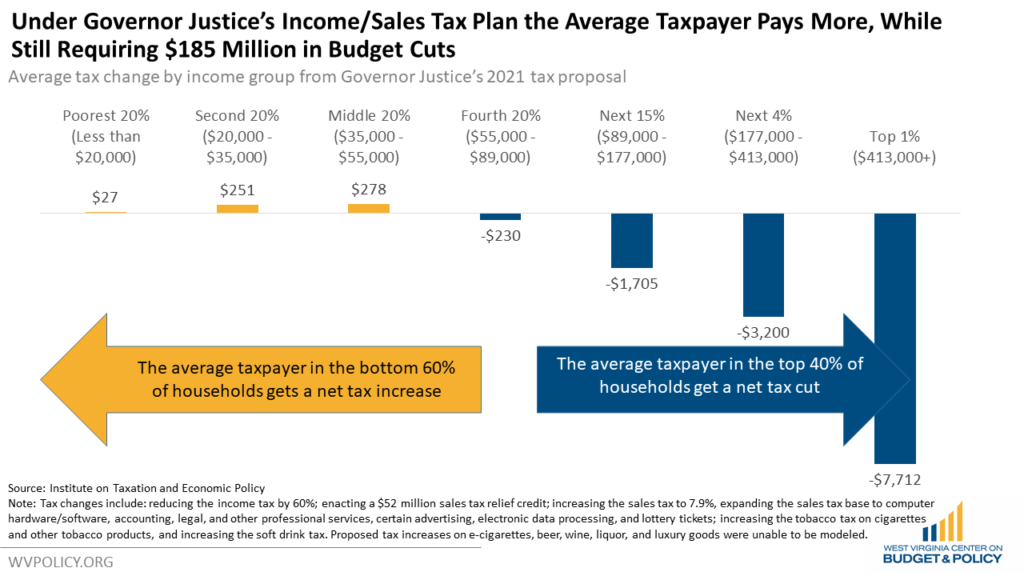

Governor Justice S Tax Plan Favors The Wealthy While Creating Large Holes In The Budget West Virginia Center On Budget Policy